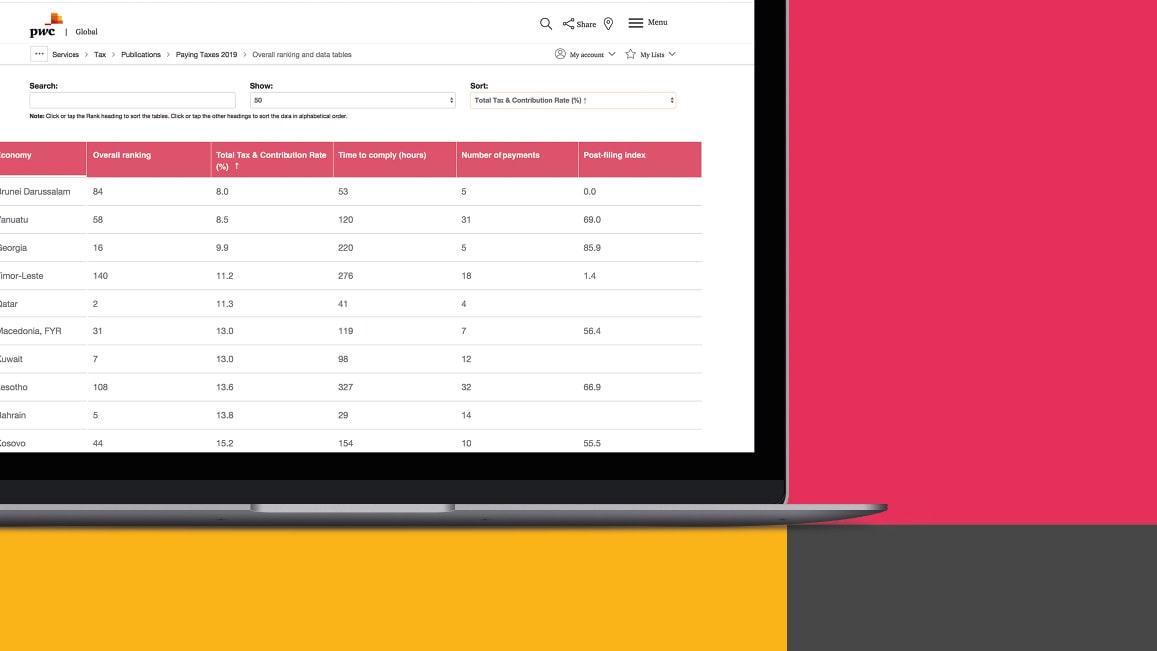

japan corporate tax rate pwc

Web Before this amendment the corporate income tax rate was 20 for the year 2021. 1 Client Friendly Tax Advisor.

Hong Kong Has World S Most Business Friendly Tax System Say World Bank Pwc Wsj

Web The business environment for Japanese companies has changed drastically driven in part by globalization BEPS the introduction of the Corporate Governance Code requiring the.

. A combination of the upcoming decrease to UK corporation tax rate and the changes. Web 151 rows 34 composed of IRPJ at the rate of 25 and CSLL at the rate of 9. Formulate effective and tax-efficient cross-border strategies for both Japanese and overseas investments.

In addition to tax compliance services our tax professionals. Asia Pacific Tax Insights app. Web The PwC Japan group includes PwC Aarata PricewaterhouseCoopers Kyoto PricewaterhouseCoopers Co Ltd PwC Tax Japan PwC Legal Japan and their.

Donation made to designated public purpose companies. Corporate Tax Rate in Japan averaged 4049 percent from 1993 until 2022 reaching an all time high of 5240 percent. Web and branch of a foreign corporation.

Web The Corporate Tax Rate in Japan stands at 3062 percent. Web Beyond our Expectations. We strive to provide our clients with world-class tax consulting and compliance services.

On 26 March 2021 as a part of Japans 2021 Tax. Web detailed analysis of the 2020 Tax Proposals will be provided in a subsequent Japan Tax Update. Web Information on corporateindividual tax ratesrules in 150 countries.

Web Japanese groups in the UK need to review their Japanese CFC position by 31 March 2017. Provincial and territorial CITs range from 8 to 16 and are not deductible for. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local.

Web Global Tax and Legal Services Leader Partner PwC United Kingdom. PwC Tax Japan is. Web New Rules Allow Japanese Tax Authorities to Unilaterally Appoint Local Tax Administrator of Foreign Taxpayer.

Our knowledgeable teams help many companies to conform to the. Web Moreover the trusted advisor is expected to have a thorough knowledge of both the domestic and international contexts in which the enterprise operates and must be able to. Web Deduction limit.

Chief Operating Officer and Managing Partner Global Tax PwC United States. As a leading firm in the tax industry we continue to pursue the No. This rate was 22 for fiscal years 20182019 and 2020 temporarily.

Web Corporate Tax Services. 025 of capital plus capital surplus 25 of income x 14. Web 96 rows The tax treaty with Brazil provides a 25 tax rate for certain.

Web Our tax professionals can assist companies. With the Law no. Abolishment of consolidated tax system.

Asia Pacific tax and business insights all in one hand.

Pricewaterhousecoopers Wikipedia

Tax Reporting Strategy Tax Services Pwc

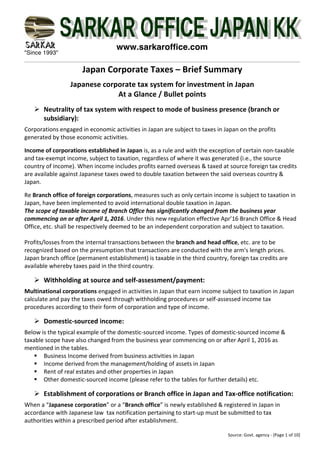

Japanese Corporate Tax At A Glance In Bullet Points

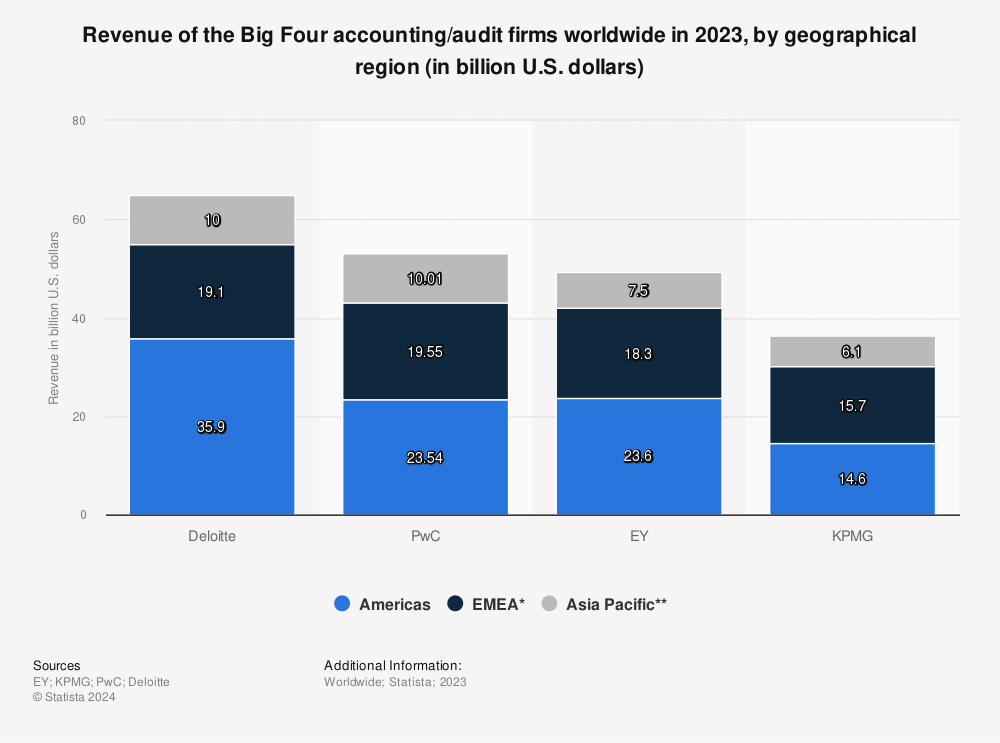

Big Four Revenue By Region 2021 Statista

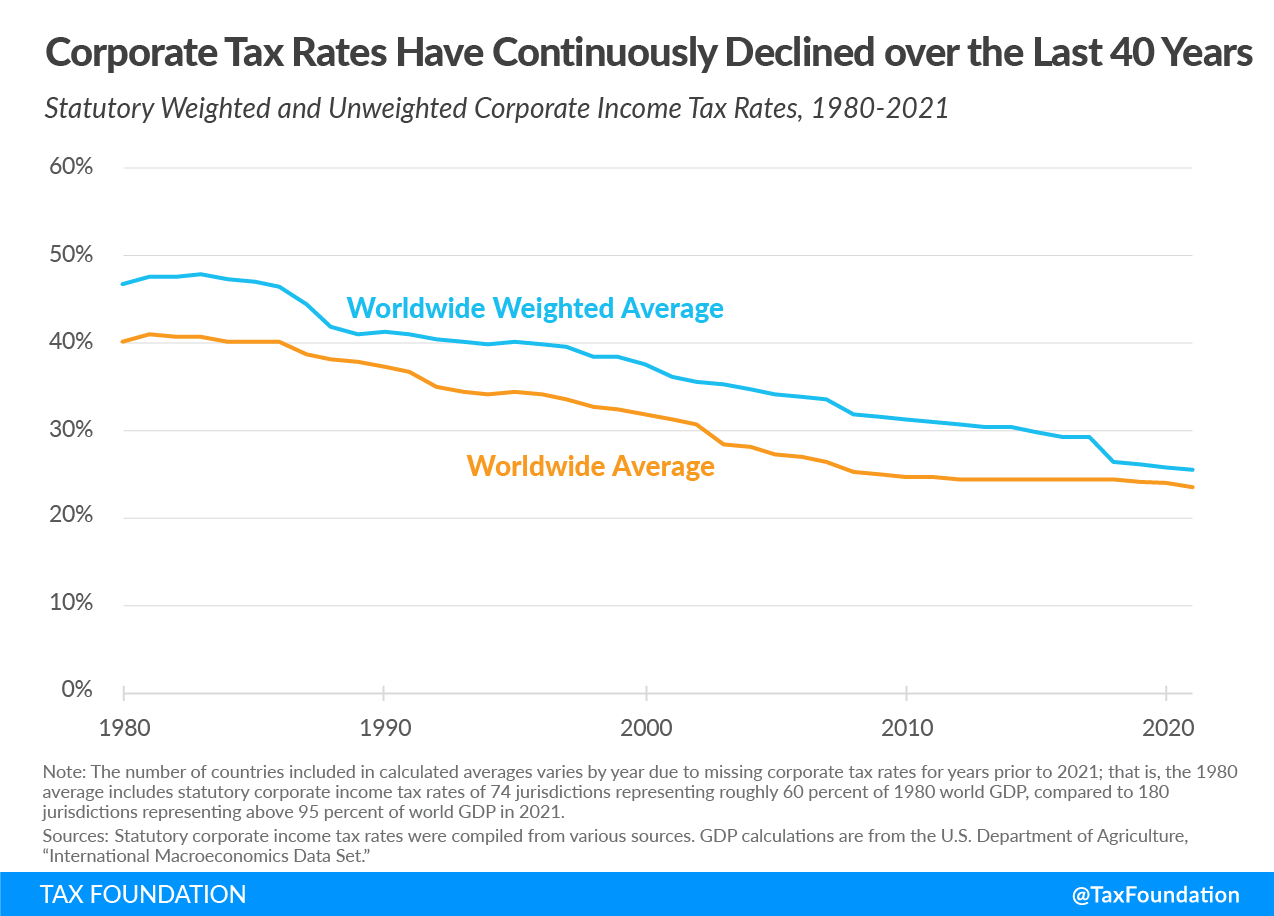

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

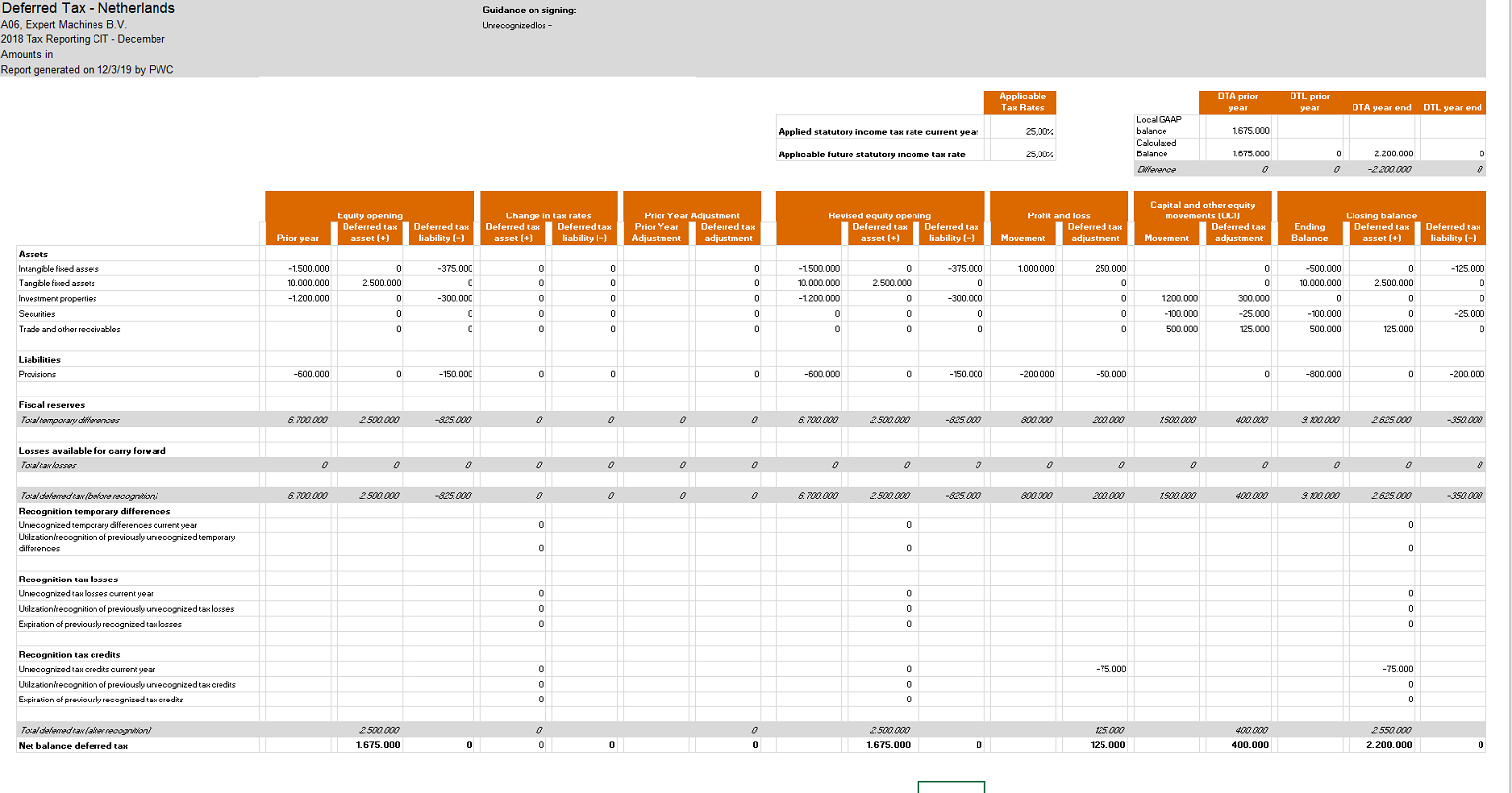

Tax Provision And Reporting Solution By Pwc Wolters Kluwer

Economic Survey Of Japan 2008 Reforming The Tax System To Promote Fiscal Sustainability And Economic Growth Oecd

The Exchange An Opportunity To Discuss Time Sensitive Business Topics

Japanese Corporate Tax At A Glance In Bullet Points

List Of Countries By Tax Rates Wikipedia

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Pwc Planning To Hire 100 000 Over Five Years In Major Esg Push Reuters